Section 80DDB of the Income Tax Act allows individuals and Hindu Undivided Families (HUFs) to claim a tax deduction on expenses incurred for the treatment of specified critical illnesses, such as cancer, kidney failure, or neurological diseases. The deduction is available for medical costs of self or dependent family members, subject to prescribed limits based on the patient’s age.

Tax laws can be overwhelming, particularly while you're managing something as distressing as a serious illness.

Let us take, for example, Rajesh. Suddenly faced with his father’s recent Parkinson’s disease diagnosis, he was concerned about finding out how and to what extent the rising clinical expenses would affect their taxes. Poor Rajesh was flying to and fro, visiting the hospital over and over again with no time to rest.

And on top of all that stress?

The medical bills were piling up like crazy. In an avalanche of climbing the hospital stairs and sleepless nights came a glimmer of hope – Section 80DDB. But the problem was that Rajesh had no clue how it worked or if they even qualified. So now he's stressed about his dad and money and trying to figure out if this tax thing could actually give them a break.

What is 80DDB of the Income Tax Act?

Medical treatments for serious illnesses can drain your savings quickly. The government knows this, which is why Section 80DDB of the Income Tax Act exists. It’s a provision that allows taxpayers to claim a deduction for expenses spent on the treatment of specified diseases and ailments.

In simple words, it reduces your taxable income by the amount you spend on these treatments, subject to certain limits. This way, you get some relief when filing your taxes. The deduction can be claimed by both resident individuals and Hindu Undivided Families (HUFs). And it covers expenses for either your own treatment or for your dependents, like a spouse, children, parents, or siblings.

Recent Updates on Section 80DDB

As of the Finance Act, 2024, there have been no major changes to the core provisions of Section 80DDB. The section continues to provide tax deductions for medical treatment of specified diseases for resident individuals and Hindu Undivided Families (HUFs).

- Deduction limits remain the same: Up to Rs. 40,000 for non-senior citizens and up to Rs. 1,00,000 for senior citizens.

- Certification requirement: Taxpayers still need to obtain a certificate from a specialist doctor as per Rule 11DD.

- Diseases: No new diseases have been added to the prescribed list of eligible conditions in 2024.

For official references, you can check:

Income-tax Act, 1961 – As amended by Finance Act, 2024 and CBDT Circulars and Notifications.

Eligibility for 80DDB of the Income Tax Act

To claim a deduction under Section 80DDB, you need to check a few boxes. It’s not complicated, but it helps to know the fine print before you file.

- First, the deduction is available only if you are a resident individual or a Hindu Undivided Family (HUF). Non-residents do not qualify.

- Second, the money spent should be on medical treatment for yourself or your dependents. If you’re an individual taxpayer, dependents include your spouse, children, parents, and even your siblings. If you file as a HUF, then any member of the family is treated as a dependent.

- Another important condition is that you can claim only the actual amount you paid for treatment. This means if your insurance company or employer reimburses you for a part of the expense, that portion cannot be claimed again under Section 80DDB. Only what comes out of your own pocket is considered.

- And there’s one more thing people often miss. This deduction is available only under the old tax regime. If you’ve shifted to the new regime, you won’t be able to use this benefit.

In short, Section 80DDB is meant to provide some relief to taxpayers who face heavy medical bills for themselves or their family members. Knowing who qualifies and under what conditions is the first step before you plan your tax savings.

Here’s a simple example:

Suppose Rohan spends Rs. 1.5 lakh on his father’s treatment. His health insurance covers Rs. 50,000. In this case, Rohan can claim only Rs. 1 lakh under Section 80DDB, since that’s the amount he actually paid. The same rule would apply if a HUF member paid for the treatment of another member.

In short, Section 80DDB is meant to give taxpayers some relief from steep medical bills, but the deduction works only within these boundaries. Knowing the rules helps you plan better and avoid disappointment later.

Deduction Under Section 80DDB

Section 80DDB of the Income Tax Act offers taxpayers in India a valuable deduction for medical expenses attached to specific serious illnesses. Whether it's Cancer, Dementia, Parkinson's Disease, Motor Neuron Disease, AIDS, or Chronic Renal Failure, this provision helps facilitate the monetary weight of these difficult medical issues.

Now, let’s discuss who all are eligible under Section 80DDB -

- Taxpayers Covered: This deduction is a valuable benefit for individual taxpayers, Hindu Undivided Families (HUFs), and residents alike, offering financial relief across various categories of taxpayers.

- Scope: To qualify for this deduction, the expenses must be for treating specified diseases and can be applied to medical costs for yourself, your spouse, dependent children, parents, or dependent siblings.

When Is Deduction Allowed Under Section 80DDB?

Under Section 80DDB of the Income Tax Act, you can claim a deduction for medical expenses associated with particular disorders or illnesses. Simply remember there are a couple of conditions you need to meet, which are as follows-

- Diseases Covered

This deduction covers medical expenses for treating significant health conditions, including dementia, cancer, motor neuron diseases, Parkinson’s disease, AIDS, and chronic renal failure, offering some assistance during these difficult stretches.

- Who Can Claim This Deduction?

It can generally be claimed by -

-

- Individual Taxpayers

- Hindu Undivided Families (HUFs)

- Residents

- Conditions For Claiming The Deduction

- Treatment Expenses: You can claim this deduction for clinical costs associated with the specified diseases, whether they’re for you, your spouse, your dependent children, parents, or even siblings.

- Required Documentation: To claim this deduction, you must provide appropriate medical documentation and verify your expenses.

- Deduction Limits: There’s a limit to how much you can claim for this deduction, and that cap can change contingent upon the latest tax rules. It’s vital to stay updated on the current regulations to guarantee you're claiming the perfect amount.

- Not Covered By 80DDB: If you're looking to claim deductions for health insurance premiums, you'll want to check out Section 80D of the Income Tax Act, not Section 80DDB.

Curious if you’re in the clear for claiming high clinical costs on your taxes? Discover who can use Section 80DDB and who’s left out!

Who Can Claim A Deduction Under Section 80DDB Of The Income Tax Act?

You can claim the deduction under Section 80DDB of the Income Tax Act for medical treatment expenses related to specified diseases if you’re -

- Individuals And Hindu Undivided Families (HUFs)

This deduction can be claimed by individual taxpayers as well as Hindu Undivided Families (HUFs).

- Requirement Of Residency

This deduction is exclusively for residents of India for the relevant financial year. Moreover, Non-Resident Indians (NRIs) cannot take advantage of this benefit.

- Incurred Expense

Only the person who has truly incurred the medical expenditures is the only one eligible to claim the deduction.

- Exclusions Under Section 80DDB

Section 80DDB doesn’t cover deductions for corporates or other entities. hence, they’re not eligible to claim this benefit.

How Much Deduction Is Allowed Under Section 80DDB?

Section 80DDB gives some relief from heavy medical bills, but the amount you can claim depends on two key factors: the patient’s age and the actual medical expenses you’ve incurred. Let’s break it down clearly so you know what to expect.

|

Category

|

Maximum Deduction Allowed

|

Notes

|

|

Individuals under 60 years

|

Rs. 40,000

|

You can claim up to Rs. 40,000, but if your actual expenses are less, the deduction will only be the amount you spent.

|

|

Senior citizens (60 years and older)

|

Rs. 1,00,000

|

The deduction is higher to ease the burden of treatment for seniors. Again, if your expenses are lower, you claim only the amount paid.

|

|

Super senior citizens (80 years and older)

|

Rs. 1,00,000

|

Same as above. The law does not provide extra beyond Rs. 1,00,000, but it ensures seniors get maximum relief.

|

And here’s a tip: The deduction applies only to actual expenses paid. If part of your treatment was reimbursed by insurance or your employer, subtract that before calculating the deduction.

Understanding these limits is crucial because it helps you plan your finances and ensures you’re claiming every rupee you’re eligible for. Proper documentation, including the prescription from the specialist and receipts of payment, is essential to avoid issues when filing your tax return.

Things To Remember While Claiming Deduction Under Section 80DDB

Here are a few crucial elements you need to remember if you want to claim a deduction under section 80DDB-

- Eligible Dependents For Individuals And Hindu Undivided Families (HUFs)

For individual taxpayers, dependents cover your spouse, kids, parents, and even siblings. As for Hindu Undivided Families (HUFs), a dependent can be any family member within the fold.

- Mandatory Medical Certificate

To claim this deduction, you'll need a certificate from a specialist. Depending on the illness, that could be a neurologist, urologist, immunologist, oncologist, haematologist, or any other qualified expert. It's extremely important to get the right specialist for the specific condition.

- Impact Of Reimbursements

If you’ve already received reimbursement for medical expenses from insurance or your employer, you can't claim the full amount as a deduction. The deductible amount gets reduced by whatever you were reimbursed. It's a rule that guarantees you don't get both the tax benefit and the reimbursement for the same expense.

- Deduction Limits Explained

Here’s how the deduction limit functions -

- For Individuals Under 60 Years: You can claim a maximum deduction of up to Rs. 40,000.

- For Senior Citizens (60 Years And Above): The deduction limit goes up to Rs. 1,00,000.

To put it plainly, both individuals and HUFs can claim deductions for medical expenses tied to certain diseases—up to Rs. 40,000 or Rs. 1,00,000, contingent upon the patient's age. Obviously, this is as long as the set circumstances are met.

Trying to disentangle which medical conditions are deductible? Here’s a quick manual to the 80DDB deduction diseases list and the specialists who need to give you the go-ahead!

Which Diseases Are Covered Under Section 80DDB?

Section 80DDB doesn’t apply to every illness. The law is very specific about which medical conditions qualify, and these are laid down under Rule 11DD of the Income Tax Act. To claim the deduction, you also need a prescription from the right type of medical specialist.

Here’s a clear breakdown of the diseases covered, along with the specialist who can certify the treatment:

|

Category of Illness

|

Conditions Covered

|

Specialist Required

|

|

Neurological Disorders (with a certified disability level of 40% or higher)

|

Dementia, Dystonia musculorum deformans, Motor neuron disease, Ataxia, Hemiballismus, Chorea, Aphasia, Parkinson’s disease

|

Neurologist with a Doctor of Medicine (DM) or equivalent degree approved by the Medical Council of India (MCI)

|

|

Malignant Cancers

|

All forms of malignant cancer

|

Oncologist with a DM or equivalent degree recognised by MCI

|

|

Full-Blown Acquired Immuno Deficiency Syndrome (AIDS)

|

AIDS (advanced stage)

|

Specialist with a postgraduate degree in General Medicine/Internal Medicine or an equivalent recognised qualification

|

|

Chronic Renal Failure

|

Advanced stages of kidney failure

|

Nephrologist with a DM in Nephrology, or Urologist with an MCh in Urology (or equivalent MCI-recognised qualification)

|

|

Hematological Disorders

|

Hemophilia, Thalassemia

|

Specialist in Hematology with a DM in Hematology or equivalent qualification recognised by MCI

|

So, if you or a dependent are undergoing treatment for any of the above conditions, you may be able to claim relief under Section 80DDB, provided the prescription comes from the right specialist.

What Documents Are Required To Claim Tax Deduction u/s 80DDB?

When you’re ready to claim that Section 80DDB deduction while filing your Income Tax Return (ITR), here’s what you’ll need to have on hand-

- Specialist’s Prescription Or Certificate

To claim a deduction under Section 80DDB, you’ll need to get a prescription or certificate from a specialist. This document should affirm the diagnosis of the specific disease you’re claiming for.

When seeking treatment at a government hospital, make sure the prescription comes from a specialist working full-time in that hospital with a postgraduate degree in General or Internal Medicine or a similar recognised qualification. Likewise, the prescription needs to specify the name and address of the government hospital where the treatment took place.

- Medical Treatment Proof

You’ll also need to provide proof that the medical treatment was actually carried out. This implies collecting and submitting documents like hospital bills, payment receipts, or any other relevant paperwork that shows you’ve incurred these expenses.

Make sure to always keep these documents handy as they serve as your proof, and they need to be submitted if necessary. While you usually only need to hang onto them for your own records, you might need to show them to the tax authorities if they ask for more details.

Need a hand with claiming your medical tax deductions? Check out this simple-to-follow guide to Section 80DDB of the Income Tax Act and guarantee you’re hitting all the right notes for maximum benefits!

How To Claim Deduction Under Section 80DDB?

To make the most of your tax benefits under Section 80DDB for medical expenses related to specific diseases, follow the below steps carefully. It’s all about getting things right and ensuring you don’t miss out on any deductions!

Step 1: Gather And Organise Your Documentation

You need to have -

- Medical Certificate: First things first: get a certificate from a licensed medical practitioner—ideally someone from a government hospital. Make sure this certificate spells out the patient’s name, the disease they’ve been diagnosed with, the costs of the treatment, and other relevant information.

- Proof Of Expenses: Assemble all medical invoices, payment receipts, and any proof of the costs paid for the treatments.

Step 2: Ensure Accurate Diagnosis And Certification

Make sure your medical certificate comes from the right specialist as per the tax rules. For instance, if it's for a neurological condition, it should be from a neurologist.

Step 3: Calculate The Deductible Amount

Figure out your deductible amount by taking the total medical expenses and subtracting any reimbursements you've gotten from insurance or your employer.

Step 4: Complete The Necessary Tax Forms

To claim your deduction, simply fill it out in your income tax return using the right form—like ITR-2 or ITR-3 if you’re an individual taxpayer.

Step 5: Attach Or Retain Your Documentation

When you’re e-filing, you don’t need to attach your documents right away. However, make sure you hang onto all those supporting documents for at least six years from the end of the financial year. The Income Tax Department might ask for them later to double-check everything.

Step 6: Submit Your Tax Return

Make sure you file your tax return before the deadline. It’s a good idea to double-check that all the numbers in your return match up with your documents, especially the amounts you’re claiming.

Step 7: Address Any Notices Promptly

If you get a notice from the Income Tax Department about your claim, don’t stress! Just make sure to respond quickly with all the paperwork that backs up your deduction. Keep everything organised and ready to show them you’ve got it all covered.

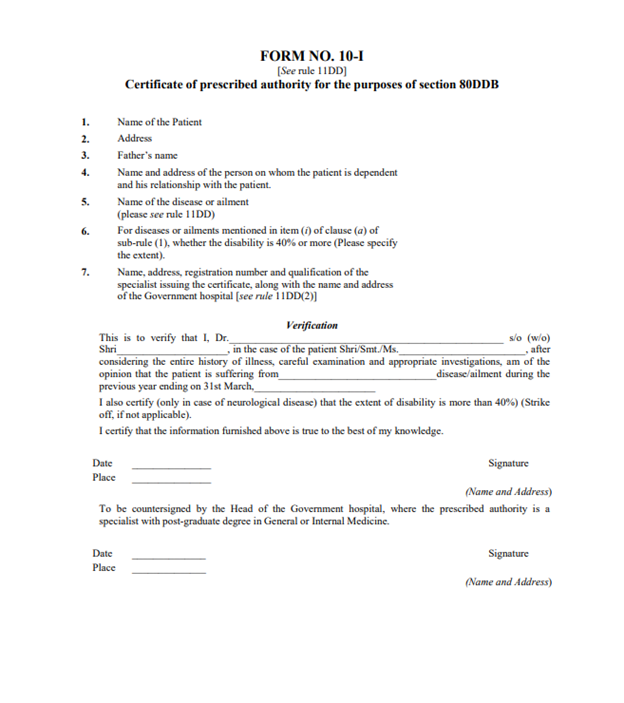

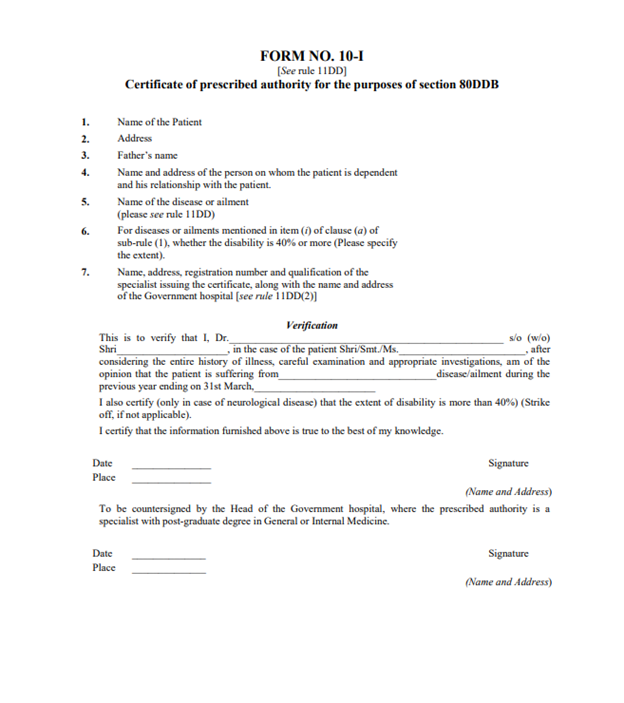

How To Get A Certificate Of The Disease For 80DDB Deduction?

To get a deduction under Section 80DDB, you’ll need a medical certificate from a qualified specialist that confirms the diagnosis of the disease you’re claiming. Here’s the lowdown on how to get that certificate-

If you go for treatment in private hospitals, you need to know the following elements-

- Certificate Issuance: Get your medical certificate from a specialist who is appropriately qualified and experienced in treating the specific disease.

- Specialist Requirements: Make sure the specialist you choose is officially recognised and has the necessary credentials related to the type of illness you’re dealing with.

And if you go for treatment in government hospitals, here’s what you need to follow -

What Should Be Mentioned In The Certificate?

When you’re claiming a deduction under Section 80DDB, getting your certificate right is crucial. Here’s what it needs to have to be both complete and valid -

- Patient Identification: Clearly spell out the patient’s full name and age.

- Diagnosis Details: Detail the specific disease or ailment being treated, as this is the core of your claim.

- Specialist’s Information: Include the specialist's name, address, and registration number—essentially, their professional ID.

- Specialist Qualifications: Highlight the specialist’s qualifications to show they're certified and capable.

- Government Hospital Information (If Relevant): If the treatment took place at a Government hospital, include its name and address to complete the picture.

Ready to learn how to claim 8ODDB deduction? Here’s your cheat sheet for crafting a prescription that ticks all the boxes—make sure your document is on point and ready to impress the Income Tax Department!

Prescription Format For Claiming 80DDB Deduction

For a smooth Section 80DDB deduction, make sure your prescription checks these key boxes -

- Proper Patient Details

- Name

- Age

- Name of Disease or Illness

- Specialist Details

- Name

- Address

- Registration Number

- Qualifications

- Government Hospital Information (If Applicable)

- Name and address of the government hospital or medical institution.

- Signatures

- Name and designation of the Head of the Department (for specialised treatment at the hospital).

- Prescribing/Treating Doctor

Note that even though Form 10-I is no longer needed, make sure your prescription includes all the required details. Keep this documentation handy, as the Income Tax Department might ask for it, even though you don’t submit it with your tax return.

How To Fill Section 80DDB Form?

To accurately fill out the Section 80DDB Form, follow these steps-

Step 1: Give The Name

Provide your full name in the form.

Step 2: Details Of The Applicant’s Parents

You need to provide your father's name and address.

Step 3: Provide The Details Of The Dependent

Kindly provide the dependent's name and address.

Step 4: Mention The Relationship Details

Indicate your relationship with the dependent, such as your spouse, child, parent, or sibling.

Step 5: Information On The Disease

Provide the name of the disease as specified under Rule 11DD.

Step 6: Level Of Disability

Specify the degree of disability, if applicable.

Step 7: Details Of Government Hospital (If Applicable)

Enter the details of the government hospital, including its name and address, where the treatment took place.

Step 8: Details Of The Treating Doctor

Please provide the full details of the treating doctor, including their name, address, qualifications, and registration number.

Step 9: Verification Process

Affix your signature on the form and double-check every detail to confirm its correctness.

Please Note: Although you don't need to submit the form with your income tax return, be sure to retain a copy of the completed form for your records. The Income Tax Department might ask for it later.

https://banadh.yolasite.com/resources/bam/form%20for%2080%20DDB%20%28itr62Form10I%29.pdf

List of Related Income Tax Sections

Understanding the Income Tax Act can feel overwhelming, but at SMC Insurance, we aim to simplify it for you. These sections are especially useful to know when planning your taxes or claiming deductions. Here’s a quick guide:

|

Section

|

What It Means

|

Why It Matters

|

|

Section 143(1)

|

Intimation from the Income Tax Department

|

Notifies taxpayers of discrepancies, refunds, or additional tax liabilities based on the return you filed. Helps ensure your filing is accurate.

|

|

Section 206AB

|

Higher TDS for non-filers

|

Applies a higher TDS rate to taxpayers who haven’t filed returns in previous years, encouraging timely compliance and avoiding penalties.

|

|

Section 115BAA

|

Optional lower tax rate for companies

|

Allows companies to pay a reduced tax rate, but certain exemptions are foregone. Useful for businesses evaluating tax-saving strategies.

|

|

Old vs New Tax Regimes (FY 2023-24 / AY 2024-25)

|

Comparison of tax regimes

|

Helps individuals determine which regime offers better savings based on income and deductions. Crucial for effective tax planning.

|

80DDB vs 80D / 80DD / 80U

Many taxpayers get confused between Section 80DDB and other similar sections like 80D, 80DD, and 80U. Each serves a slightly different purpose, so knowing the distinctions can help you claim the right deductions and avoid mistakes. Here’s a quick comparison:

|

Section

|

Who It Applies To

|

What It Covers

|

Maximum Deduction

|

|

80DDB

|

Resident individuals or HUFs

|

Medical treatment for specified diseases for self or dependents

|

Rs. 40,000 (under 60 yrs) / Rs. 1,00,000 (60+ yrs)

|

|

80D

|

Individual / HUF

|

Health insurance premiums for self, family, and parents

|

Rs. 25,000 (under 60 yrs) / Rs. 50,000 (senior citizens)

|

|

80DD

|

Individual / HUF

|

Expenses for a dependent with disability

|

Rs. 75,000 (normal) / Rs. 1,25,000 (severe disability)

|

|

80U

|

Individual taxpayer

|

Disability of the taxpayer themselves

|

Rs. 75,000 (normal) / Rs. 1,25,000 (severe disability)

|

As you can see, 80DDB focuses specifically on serious illnesses and requires a specialist’s prescription, while 80D is mainly about insurance premiums. Sections 80DD and 80U deal with disabilities, either of a dependent or yourself. Understanding this difference ensures you don’t miss out on deductions you’re eligible for.

Common Mistakes & Notice Triggers

Even when you qualify for deductions, small errors can trigger notices from the Income Tax Department. Here’s what to watch out for:

- Incorrect or Missing Medical Certificate

Section 80DDB requires a certificate from a recognized specialist. Submitting the wrong format or missing details can raise a red flag.

- Claiming Reimbursed Expenses

Only the actual out-of-pocket expense counts. If part of the bill is reimbursed by insurance or your employer, claiming the full amount can trigger scrutiny.

- Wrong Section Used

Confusing 80DDB with 80D, 80DD, or 80U can lead to rejection of your deduction claim.

- Exceeding Age-Based Limits

Deduction limits differ for those under 60, 60+, and 80+. Claiming more than allowed can invite a notice.

- Non-Resident Claims

80DDB applies only to residents. Non-resident claims are not valid.

Avoiding these common mistakes not only reduces the risk of receiving tax notices but also ensures your claim is smooth and hassle-free. Keep proper documentation, double-check your eligibility, and follow the prescribed formats for certificates and receipts.

Resident Taxpayers

Section 80DDB is designed specifically for residents of India. This means only individuals who live in India and Hindu Undivided Families (HUFs) can claim the deduction. Non-residents, even if they incur similar medical expenses in India, are not eligible.

In simple terms, if you file your taxes in India as a resident, you can take advantage of this deduction. But if you are an NRI or your primary residence is abroad, you won’t be able to claim it. This rule ensures that the benefit targets taxpayers contributing to the Indian tax system.

In Summary

While managing heavy hospital expenses, Section 80DDB can be a genuine lifeline, offering deductions for those battling severe health issues. It's pivotal to understand what qualifies, what paperwork you need, and the 80DDB deduction limit on how much you can claim. While you don’t submit the form with your tax return, keeping it handy for future reference is a brilliant move. So, make sure you’re on top of the details and have everything in order. If you’re ever unsure, a quick chat with a tax expert may very well assist you with exploring the cycle without a hitch and getting the most out of your deductions.

Disclaimer

The content on this page is generic and shared only for informative and explanatory purposes. It is sourced from multiple online resources and may be subject to change. Kindly seek advice from an expert before making any decisions related to the discussed subject matter.