Are you curious about the Atal Pension Yojana (APY)? Well, for Maya, it's like a superhero disguised.

“Amma, what are you going to do when you get older?” asked 12-year-old Priya, watching her mother, Maya, cautiously count the day's income from her small tea stall.

Maya smiled, pulling out a worn document from her drawer. "See this? This is my secret superhero - my pension plan!" she said, her eyes twinkling.

In a country in which millions wake up each morning and head to work so they might eat the next day, the very notion of retirement often feels like a faraway fantasy. This is where the Atal Pension Yojana (APY) steps in, rolling out the red carpet for your retirement. A transformational pension scheme that is designed to change the perception of long-term financial planning among millions of India's workforce, specifically targeting poor and underprivileged workers.

Just like how health insurance helps you against surprising clinical costs, the APY can protect your future against monetary vulnerabilities in your golden years.

In this article, we'll investigate all that you want to know about the Atal Pension Yojana: what it offers, how it works, and why it could be a smart choice for your retirement planning.

So, let’s begin!

What Is Atal Pension Yojana (APY)?

It is a scheme initiated by the government to provide a regular source of income in old age, particularly to people working in the unorganised sectors. Launched for individuals between 18 and 40 years of age, the scheme is open to Indian citizens who do not pay income tax. It requires regular contribution payments from subscribers, ensuring financial security in retirement without economic disparity among beneficiaries.

After the age of 60, individuals who join the plan are eligible to be given a monthly guaranteed pension in the range of Rs. 1,000 to Rs. 5,000, contingent on how much they have contributed while making the payments.

The APY scheme is essentially for the workers in the unorganised sector who belong to the poor or underprivileged section. It helps them save something for their old age so that they can spend their golden days with dignity.

Also, this scheme is managed by the Pension Fund Regulatory and Development Authority (PFRDA) using the framework of the National Pension System (NPS).

From lifetime pensions to tax perks, APY has it all! Let’s break down why it’s a win-win for your future!

Key Features And Benefits Of The Atal Pension Yojana

Here’s an overview of the prominent features and benefits of the Atal Pension Yojana:

- Assured Minimum Pension

Subscribers will enjoy a monthly pension amounting to a minimum of Rs. 1,000 up to Rs. 5,000 after they turn 60, till their death. This amount is based on their contribution built up over the years.

- Financial Security For Your Spouse

The spouse gets the same amount of pension for the remainder of their life if the subscriber passes away.

- Nominee’s Share Of Pension Wealth

When both the primary insured (subscriber) and the secondary insured (spouse) pass away, the nominee, typically their child, is entitled to receive the lump sum corpus accrued during the accumulation period.

- Government’s Co-Contribution Boost

Eligible subscribers who joined the scheme between June 1, 2015, and March 31, 2016, qualified for government co-contribution. This co-contribution, amounting to 50% of the total contribution or a maximum of Rs. 1,000, will be deposited into the subscriber’s savings or post office account at the end of the financial year. However, those who are already beneficiaries of statutory social security schemes are not eligible for such a benefit under APY.

- Voluntary Exit Option

Subscribers have the option to exit the scheme before turning 60. In such cases, they will receive the contributions they made to APY along with the net income earned on those contributions after deducting account maintenance charges. The people who had joined before 31st March 2016 and had opted for the co-contribution provided by the government would lose both the co-contribution and the earnings accrued thereon.

- Flexibility For The Spouse

If the subscriber passes away before attaining the age of 60, their spouse is given the choice to either continue to contribute to the APY account or withdraw the entire accumulated corpus that would then be paid to the spouse or nominee.

Eligibility Criteria For The Atal Pension Yojana

If you are keen on securing your future through this scheme, then the following information about eligibility criteria would be important to you:

- Age: Any individual aged between 18 and 40 years is eligible to join the APY.

- Citizenship: All Indian citizens having a savings account or post office savings bank account are eligible for the APY scheme.

- Status Of Income Tax: Starting October 1, 2022, individuals who have been or are income taxpayers are no longer allowed to become members of the APY.

- Flexible Contribution Options: The subscribers are supposed to contribute through auto-debit from their post office savings bank account or savings account on a monthly, half-yearly, or quarterly basis until they are 60 years of age from the age of joining APY. The monthly/quarterly/half-yearly contribution varies based on the desired/intended monthly pension and age at entry.

- Your Pension Starts At 60: Your guaranteed pension starts when you hit 60.

- Additional Details: After you register, your Aadhaar and mobile number can be provided to your bank so that you can receive regular notifications concerning your APY account. But do note that Aadhaar is not a compulsory requirement for registering.

How To Register For Atal Pension Yojana: A Quick Step-By-Step Guide?

If you're ready to secure your retirement with the Atal Pension Yojana, registration is a very easy process. It can be done either online or offline. Together, let's go over each step of the procedure:

Atal Pension Yojana Apply Online

Here are the different ways through which you can apply for Atal Pension Yojana online-

Through Net Banking:

Step 1: Login to your Internet banking account to access your account online.

Step 2: Locate "APY" on your account dashboard.

Step 3: Fill in your basic information, including the details of your nominee.

Step 4: Authorise the automatic deduction of the premium from your bank account.

Step 5: Complete the registration by submitting the form.

Through eNPS Website:

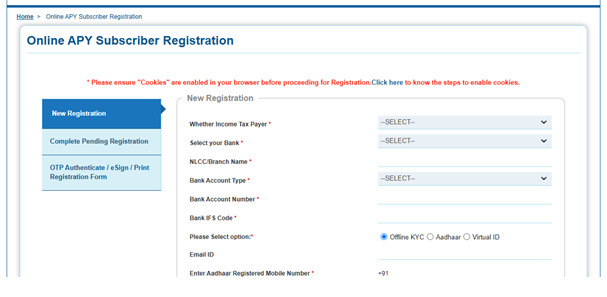

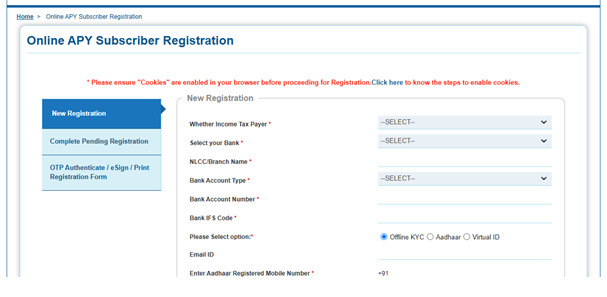

Step 1: For New Registration

- Go to the eNPS website.

- Select "New Registration" to get started.

- Fill in all the details:

- Income Tax Payer: Choose either "Yes" or "No" based on your tax status.

- Bank Details: Select the bank and fill in the branch name, account type, and account number, followed by the IFS code.

- KYC Options: Choose between offline KYC, Aadhaar, or virtual ID.

- Email ID: Type your Email ID.

- Aadhaar Registered Mobile Number: Enter the mobile number that is associated with your Aadhaar account.

- Aadhaar Last Digit: Enter the last digit of your Aadhaar number.

- Upload Aadhaar e-KYC XML File: If needed, upload the ZIP file downloaded from the UIDAI website.

- Provide The Share Code: Enter the share code for your paperless offline eKYC process.

- Select Your Pension Amount: Choose the amount you’d like to receive as your pension.

- Choose Contribution Frequency: Select how often you want to contribute (monthly, quarterly, or other methods).

- Authorise Bank Auto-Debit: Accept the terms that allow the bank to automatically debit your account for pension payments until you turn 60.

- Enter Captcha: Type in the CAPTCHA to verify your identity.

- Click Submit: Press the "Submit" button to continue.

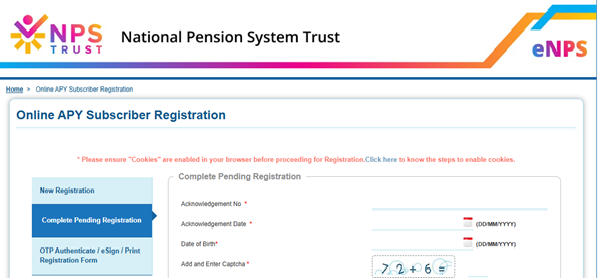

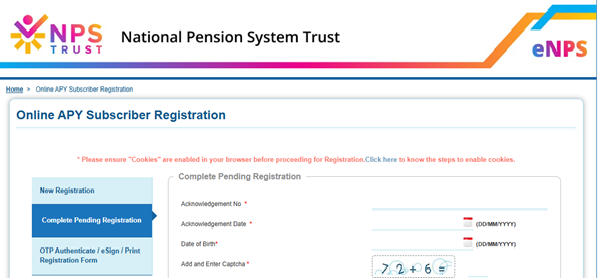

Step 2: Finish Pending Registration

- Click on "Complete Pending Registration" to continue.

- Provide your Acknowledgement Number and Acknowledgement Date.

- Enter your Date of Birth in the required field.

- Type in the CAPTCHA to proceed further.

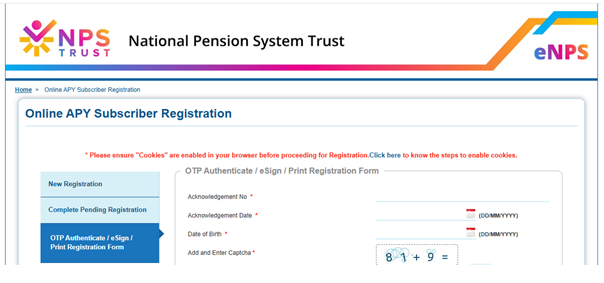

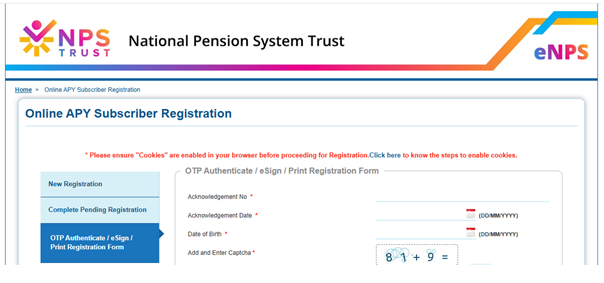

Step 3: Verify with OTP or eSign

- To continue, click on the option for "OTP Authenticate/eSign/Print Registration Form."

- You’ll be asked to enter your Acknowledgement Number, Acknowledgement Date, and Date of Birth one more time.

- Type in the CAPTCHA to verify your information.

- Next, authenticate your details through either OTP or eSign.

- Once you’ve successfully authenticated, you can proceed to complete your registration.

Offline Registration

If online registration isn’t your thing, you can easily sign up at your nearest bank or post office. Just follow these simple steps:

- Go To Your Bank Or Post Office: Visit the bank branch or post office where your savings account is maintained.

- Submit The APY Registration Form: Hand over the completed registration form to open your APY account.

Documents Required:

The KYC details are obtained from an active savings account in the bank or post office.

Helpline:

Help is just a call away on the toll-free helpline at 1800-110-069.

A Guide On How To Do Atal Pension Yojana Login

You can log in to this scheme through multiple channels. Let’s look at them below:

Through Website

Logging into the Atal Pension Yojana through the website is simple. Here is how to do it:

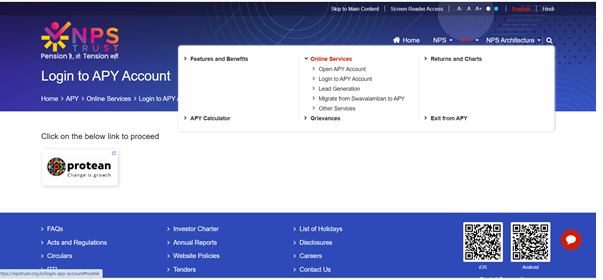

Step 1: Access the National Pension System Trust's official website.

Step 2: Search for and click on the "APY" section on the homepage.

Step 3: From the listed options, select "Online Services."

Step 4: Fill in your PRAN (Permanent Retirement Account Number) details in the designated fields.

Step 5: Hit the "Login" button to proceed.

Step 6: Input the OTP received on your registered mobile number to complete the APY login process successfully.

Through Mobile App

Here’s a step-by-step guide to accessing Atal Pension Yojana through the APY and NPS Lite mobile app:

Step 1: Install The APY And NPS Lite App

- Launch the Google Play Store on your phone.

- Type "APY and NPS Lite" into the search bar and choose the official app from the list of results.

- Hit the "Install" button to download and set up the app on your phone.

Step 2: Input Your PRAN Details And Hit "Login"

- After the app is installed, launch it.

- On the login screen, input your Permanent Retirement Account Number (PRAN), which is the unique ID you receive when you register for the Atal Pension Yojana or National Pension System (NPS).

- Once the PRAN is entered, hit the "Login" button to move forward.

Step 3: Enter The OTP Received On Your Registered Mobile Number

- When you click "Login," the app will send an OTP to the mobile number connected to your PRAN.

- Check your messages or notifications for the OTP, then enter it into the field in the app.

- Press the "Submit" or "Verify" button to finish logging in and access your APY account.

How To View Your APY Statement Online?

Here’s an easy process for you to check your Atal Pension Yojana statement online:

Step 1: Go To The Official Website

Visit the official APY website.

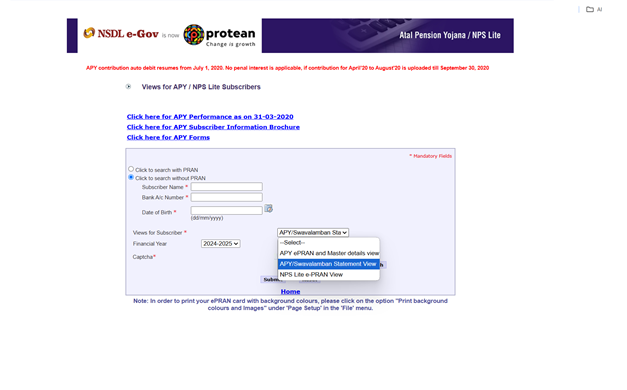

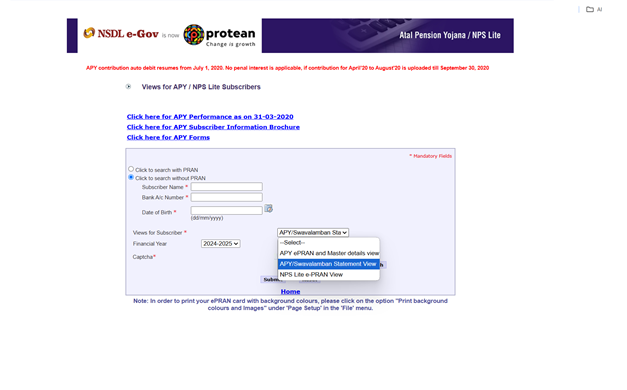

Step 2: Select The PRAN Option

- Choose either "With PRAN" or "Without PRAN."

- If you select "With PRAN," log in using your 12-digit Permanent Retirement Account Number (PRAN) along with your bank account details.

- For the "Without PRAN" option, simply enter your bank account number, your name, and your date of birth to log in.

- Next, open the dropdown menu and select ‘APY/Swavalamban Statement View’ (as described below). Choose the financial year, enter the Captcha correctly, and then hit the ‘Submit’ button.

- After logging in, a new page will open with your APY statement displayed.

Here’s an alternate method as well. Let’s look at it below:

Step 1: Download The NPS Lite & APY Mobile App

Install the app and log in using your PRAN details.

Step 2: Verify With OTP

Check your registered mobile for the OTP and enter it.

Step 3: View Your Statement

Once confirmed, the app will display your transaction statement with all the details like total holdings, asset distribution, pension information, and much more.

Contact Details For The Atal Pension Yojana Scheme?

In case you need help or have any questions about your Atal Pension Yojana account, then a call-away is always available.

- Toll-Free Number: 1800 889 1030 for APY support.

- New NPS-CRA Toll-Free Number: 1800 210 0080. Please note that the old number will be discontinued soon.

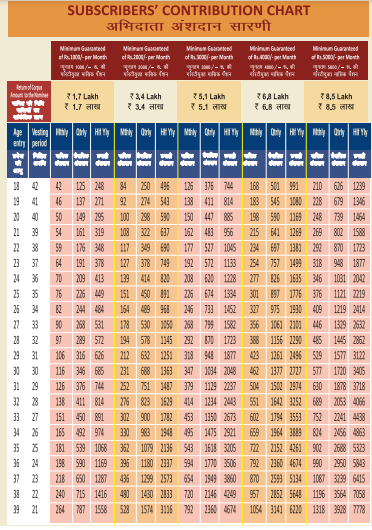

Atal Pension Yojana Contribution Breakdown

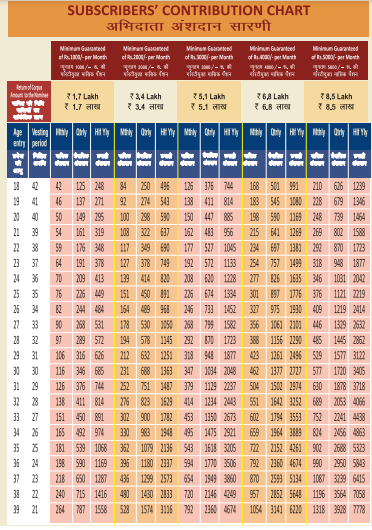

The contribution chart for Atal Pension Yojana highlights the payments necessary to earn a specific pension amount. Check out the table below for a clearer picture:

Source: National Pension System (NPS) Trust

Withdrawal Process In Atal Pension Yojana

APY ensures retirement security, but life can change things. Whether you're turning 60 or opting for an early exit, understanding withdrawals is key. So, let’s look at it below:

|

Scenario

|

Withdrawal Process

|

|

Once you hit 60 years of age

|

- Request For Guaranteed Monthly Pension: Request the linked bank to begin disbursing the guaranteed minimum monthly pension or a higher amount based on investment returns.

- Pension For Spouse After Subscriber's Death: In the event of the subscriber's death, the same pension amount is paid to their spouse, who is considered the default nominee.

- Payout To Nominee: In the unfortunate event that both the subscriber and their spouse pass away, the accumulated pension funds are transferred to the chosen nominee.

|

|

Subscriber's Passing After Reaching 60

|

- Pension Continuation: Upon the subscriber's passing, the same pension amount will continue to be paid to the spouse.

- Pension Wealth Return: If both the subscriber and the spouse pass away, the accumulated pension wealth, up until the subscriber’s age of 60, will be returned to the nominee.

|

|

Exiting the Scheme Before Turning 60

|

- Refund On Voluntary Exit Before 60: If the subscriber decides to exit the APY voluntarily before turning 60, they will receive a refund of their own contributions along with the actual income earned after deducting any applicable account maintenance charges.

- Non-Refundable Government Contributions: The government’s co-contribution, along with any interest earned on it, will not be refunded if the subscriber exits the scheme.

|

|

Subscriber's Death Before Reaching 60

|

- Spouse's Contribution Option: If the subscriber passes away, their spouse has the option to continue contributing to the APY account until the subscriber’s age has reached 60.

- Spouse's Pension Rights: The spouse will continue to receive the same pension amount as the subscriber until their own passing.

- Option For Spouse/Nominee: The spouse or nominee has the option to receive the accumulated corpus instead of the monthly pension.

|

Documents Needed For Death Withdrawal

The nominee or claimant needs to provide the following documents:

- A filled-out Death Withdrawal Form must be submitted.

- A certified copy of the subscriber's death certificate is required.

- The nominee or claimant must provide KYC documents, including proof of identity and address.

- Bank account proof for the nominee or claimant needs to be provided.

- In case the nominee's information is missing from the Central Recordkeeping Agency’s (CRA) system, the claimant will need to submit either a legal heir certificate or an authenticated copy of a family member's certificate.

Documents Required For Superannuation Or Premature Exit

The subscriber is required to provide the following documents:

- Submit a completed withdrawal form.

- Provide a stamped receipt, filled out and signed.

- Include KYC documents with the subscriber’s photo ID and address proof.

- Attach a cancelled cheque or bank certificate with the subscriber’s name, account number, and IFSC code.

- Provide a self-attested copy of the subscriber’s bank passbook showing your name, photograph, and IFSC code.

- Submit the "Request Cum Undertaking" form if eligible for a full withdrawal.

In Summary

The Atal Pension Yojana is a very simple yet exceptionally useful asset when it comes to securing the future. It is a smooth, solid way to retire with the special reward of government support. There's no need to worry about the future when there's a plan in place that's designed to give everyone, especially those in the unorganised sector; this scheme is like financial safety, built for real peace of mind. Much like you buy insurance for life's uncertainties, APY secures your finances for retirement when you are no longer working and have no regular source of income. A small investment today can ensure a simple and hassle-free life after retirement.

Disclaimer

The content on this page is generic and shared only for informative and explanatory purposes. It is sourced from multiple online resources and may be subject to change. Kindly seek advice from an expert before making any decisions related to the discussed subject matter.

FAQs

The Atal Pension Yojana (APY) provides a guaranteed monthly pension for Indian citizens aged 18 to 40, primarily targeting those in the unorganized sector, except taxpayers. The subscriber would receive an amount of Rs. 1000 to Rs. 5000 each month, with the benefits extendable to their spouse as well as the nominee.

Once a subscriber attains the age of 60, the scheme ensures that they will receive a monthly pension from Rs 1,000 to Rs 5,000. The amount entirely depends on how much a subscriber has contributed over time.

The Atal Pension Yojana (APY) mandates a minimum contribution period of 20 years for subscribers aged 18-40. Contributions can be made monthly, quarterly, or half-yearly. To exit the scheme, subscribers must submit a closure form through their bank.

In APY, the pension can be more than Rs 5,000 if the returns from the subscriber's contributions during the subscription period are higher than expected. Pension funds are invested in accordance with the PFRDA guidelines, and any returns above the expected ones go directly to the subscriber. But on the other side, if the returns are lower, then the government needs to mediate so that the subscriber still gets the guaranteed minimum pension.PFRDA guidelines

From 1st January 2025, EPS 1995 pensioners will get their pensions from any bank branch in India. The earlier geographical restrictions on certain rules have been removed. Now, pensioners can receive their pensions from any bank or branch of their choice.rules