A farm isn’t just a piece of land; it holds dreams, sweat, and the hope for a healthier tomorrow. But nature can be unpredictable- sometimes it nurtures like a mother; the next, it unleashes its fury. Pradhan Mantri Fasal Bima Yojana ensures that when the skies get darker, farmers don’t lose everything.

Ramesh is a farmer from Maharashtra who works very hard. He worked hard for months taking care of the crops, comparing them with the standard growth picture and hoping to get a good harvest that could feed his family.

Then disaster struck.

A sudden storm swept through his village and destroyed everything he nurtured. Overnight, all his hopes of a profitable season were over. The looming debt, the uncertainty of the future—how was he going to recover?

Poor Ramesh is not alone. Every year, millions of farmers in India face similar problems—unpredictable weather, pest attacks, and natural disasters- everything threatening their hard work and financial stability.

But what if these farmers didn’t have to battle these uncertainties alone? What if they had a solid backup plan- a financial safety net to catch them when nature plays rough? Wouldn’t that change everything?

That's exactly what Pradhan Mantri Fasal Bima Yojana (PMFBY) offers—a government-backed safety net to protect farmers from the unpredictability of nature.

Launched on February 18, 2016, the PMFBY ensures farm loans are not lost with low-cost crop insurance.

So, how does this scheme work? What are its benefits? Who can apply for it, and most importantly, how?

In this guide, we break down everything about PMFBY into simple words so that every farmer, and concerned citizen understands how it transforms lives.

Let's get started!

Objectives Of PMFBY: Pradhan Mantri Fasal Bima Yojana

The Pradhan Mantri Fasal Bima Yojana (PMFBY), launched on 18 February 2016 under the Ministry of Agriculture and Farmers' Welfare as a government-led crop insurance program, aims at providing insurance covers for over 50 different crops to the agricultural fraternity of more than 50 crore farmers through an affordable platform.

The implementation of PMFBY is through insurance companies and banks, which makes it accessible and efficient for farmers across the country. Here’s a rundown of the objectives:

- Safeguarding Farmers Against Crop Loss

One of the major objectives of PMFBY is to safeguard the farmer from any financial shocks and provide insurance coverage due to crop failures resulting from natural disasters, pest attacks, or diseases. Farmers can then easily recover and get back to farming without any fear of being completely financially devastated.

- Ensuring Financial Stability for Farmers

PMFBY is designed to protect farmers' income, helping them maintain their agricultural activities without facing severe financial hardship due to crop damage. The scheme aims to offer financial security, enabling farmers to sustain their livelihoods despite adverse conditions.

- Promoting Modern Agricultural Practices

The scheme guarantees financial security and encourages farmers to adopt modern, advanced agricultural techniques. The system lets them try new technologies and innovative practices, fostering a supportive environment for farmers to feel more confident in exploring.

- Promoting Diverse Cropping Practices

The PMFBY seeks to boost crops as a means of reducing dependence on a single crop. This can be achieved through spreading risks in various crops; the scheme enables farmers to establish a more stable farming system by improving financial sustainability and stability for them

- Facilitating Access to Credit for Farmers

PMFBY provides financial security, thereby boosting farmers' access to credit and loans from banks and financial institutions. Having financial security enables farmers to secure loans and credit from banks, which in turn fosters growth and development within the agricultural sector.

Main Highlights Of Pradhan Mantri Fasal Bima Yojana (PMFBY)

Let's explore the key features that make this scheme a vital safeguard for the agricultural community:

- Comprehensive Risk Coverage for Farmers

PMFBY grants wide protection at multiple stages of crop growth, protecting farmers against a variety of unpredictable risks. These include those arising because of inadequate rainfall or unfavourable weather conditions, which prevent sowing or planting. It guards crops against other risks, including drought, floods, pest attacks, and storms. In addition, farmers are insured against post-harvest losses within a span of two weeks due to specific events, such as the occurrence of cyclones and unseasonal rains. Coverage is extended beyond that to regional disasters, such as hailstorms, landslides, and flooding, impacting isolated farms in the affected areas.

- Affordable Premiums with Government Support

Farmers also get highly subsidised premiums under PMFBY. For Kharif crops, they pay 2%; for Rabi crops, 1.5%; and for commercial horticulture crops, 5%. The remaining premium is paid by the government to ensure that the financial burden on the farmers is the least. It should also be noted that in several states, the government is responsible for paying the entire premium. Here, the government subsidy has no maximum limit.

- Use of Technology for Better Claims Settlement

PMFBY utilises satellite imagery, drones, and mobile apps to assess crop loss most effectively. All this modern technology reduces delays in the claim settlement process and ensures that the claim is fair and accurate while providing maximum transparency to the procedure.

- Streamlined and Timely Claims Processing

PMFBY ensures that claims are processed efficiently, with a goal of settlement within two months following harvest. The scheme covers not just yield losses but also damage caused by localised disasters, such as hailstorms and landslides, that impact isolated regions. This ensures that farmers receive prompt financial assistance when they need it most.

The insurance plan is managed by a single entity, the Agriculture Insurance Company of India (AIC), with support from empanelled private insurance companies, as designated by the ministry. States have the flexibility to choose which private insurers participate in the government-backed crop insurance program to act as the Implementing Agency (IA), but each state will have a single insurance provider to streamline the process.

How PMFBY Benefits Farmers: Key Advantages of the Scheme

The Pradhan Mantri Fasal Bima Yojana offers several benefits that help farmers across the uncertain nature of agriculture and give them significant support. Let's take a look at how this benefits farmers.

- Minimal Premium Expenses of the Farmers: PMFBY provides cheap premium rates for farmers, who have to pay only 2% for Kharif crops, Rabi crops at 1.5%, and 5% for commercial horticultural crops. The remaining amount is covered by the government, thereby reducing the premium of insurance. In states like Jammu & Kashmir, Himachal Pradesh, and the North-Eastern regions, the government pays the entire premium.

- Government's Support and Subsidy: The government provides huge subsidies, absorbing the majority of the premium, which eases the financial burden on farmers. In some regions, where the government bears the full premium, the scheme is even accessible to farmers with limited resources, providing them with essential financial security.

- Wide-Ranging Coverage for Farmers: PMFBY encompasses wide protection towards various risks, with natural calamity risks like the ones from droughts or floods and those caused by other pests and diseases, localised perils, especially hailstorms or landslides. It also provides coverage for post-harvest losses for up to 14 days after harvesting. specifically for crops that are left in a "cut and spread" condition to dry in the field.

- Compensation on Time: The aim of the scheme is to process the claims quickly and target giving compensation within two months after harvest. This quick payment allows farmers to recover quickly and not experience financial stress, preventing them from getting into debt.

- Technological Implementation: To ensure proper loss assessment of crops, PMFBY uses state-of-the-art technologies like satellite imagery, drones, and mobile applications. They help collect real-time data in the fastest manner possible and enable claims with complete transparency as the delay factor will be absent.

Exploring The Coverage Offered By PMFBY

Extensive coverage under PMFBY provides security to farmers against multiple risks. Let's therefore examine the coverage that this critical scheme promises:

- Area-Specific Coverage

PMFBY works on an "Area Approach Basis," wherein 'Notified Areas' in each crop location are covered through insurance for individual farmers. So, all such farmers in any given area sharing the same challenges of risk environment, production climate, and all other income-linked factors are invariably covered. Typically, major crops are covered through the village or village panchayat level, whereas for other crops the coverage may extend to a broader area, depending on the size of the cultivated land. In the future, the scheme will use geo-fencing technology in defining areas having similar risk profiles for even more targeted coverage.

- Comprehensive Crop Coverage Under PMFBY

PMFBY offers insurance coverage on a very wide range of crops, including food crops such as cereals, millets, pulses, oilseeds, and annual commercial or horticultural crops, so long as historical yield data is available. It offers crop insurance coverage of crop losses during the specified season through crop-cutting experiments conducted in the notified area to ascertain yield losses. This insurance guards against natural disasters, pests, diseases, and even post-harvest losses arising from localised calamities, such as hailstorms.

- Eligibility and Coverage for Farmers

Farmers growing the notified crops in the notified areas are covered under PMFBY. The scheme is compulsory for those who have availed crop loans or have a Kisan Credit Card (KCC) for the notified crops. Such farmers are covered automatically, and the coverage amount is decided based on the loan scale, which can be scaled up to the threshold yield value. The government pays the premium for these farmers, while banks finance the insurance charges through loans.

- Voluntary Coverage for Non-Loanee Farmers

Non-loanee farmers may also take up PMFBY under voluntary coverage. The sum insured is the multiplication of the threshold yield of the crop by the Minimum Support Price (MSP) or farm gate price. In order to obtain the same, there is a must requirement for the provision of desired documents, like a record of land and agreement. Dedicated initiatives ensure the inclusion of marginalised farmers, including SC/ST and women farmers.

- Insurance Amount and Premiums

For all the loanee farmers, the insurance coverage is determined by the Scale of Finance (SOF), which represents the cost required to cultivate a crop per unit of land. The sum insured of voluntary farmers can be calculated by multiplying the crop threshold yield and the MSP/farm gate price. If one could not establish the current MSP for the respective crop, a default would rely on the preceding year's MSP. To make the scheme more affordable, the government subsidises premiums for both loanees and voluntary farmers. For loanee farmers, the bank covers the insurance charges through the loan.

Glance Over The Risks Covered By PMFBY

Here's an overview of the key risks covered under the scheme:

- Prevented Sowing/Planting Risk

If the climatic conditions do not allow for the sowing and planting of crops, or less rainfall, or seasonally unfavourable climatic conditions in a notified area, then the insured farmers in such an area may claim indemnity. This coverage comes into effect when a significant number of farmers in a designated area experience the same challenge. The actual indemnity that can be claimed is up to 25 per cent of the sum insured for that crop.

- Standing Crop Risk (Sowing to Harvest)

PMFBY provides comprehensive coverage for yield loss between sowing and harvest because of unanticipated and uncontrollable events like:

- Natural Fires and Lightning

- Flooding, Inundation, and Landslides

- Pests and Diseases

- Storms, Hailstorms, Cyclones, Typhoons, Tempests, Hurricanes, and Tornadoes

- Flooding, Inundation, and Landslides

- Drought and Dry Spells

Thus, these kinds of losses help the farmers by getting some monetary relief once the crop suffers at the time of the cultivation period because of adverse weather conditions or due to pests and diseases.

- Post-Harvest Losses

PMFBY covers crops left in the field in a "cut and spread" condition after harvesting, usually for drying. This cover is up to 14 days after harvesting and covers damages due to specific events such as:

- Cyclones or Cyclonic Rains

- Unseasonal Rains

This post-harvest coverage ensures that farmers get compensated for crop damages resulting from unpredictable weather after harvest time.

- Localised Calamities

The plan also covers localised risks that hit individual farms in the notified area. These include:

- Hailstorms

- Landslides

- Inundation

This protection is mainly to protect farmers whose crops are destroyed by localised disasters, meaning areas that may not affect the whole notified area but cause heavy losses to specific farms.

- All-Inclusive Risk Protection

This protects the farmer comprehensively throughout the entire crop cycle, from the delay in sowing and bad weather during the growth period up to unforeseen events after the harvest. PMFBY thereby helps farmers mitigate their financial stress.

What’s Not Covered Under PMFBY?

While PMFBY provides extensive coverage, there are certain exclusions. Here’s a look at what the scheme does not cover:

- War and Associated Risks: This coverage does not take crop loss because of war, civil commotion, terrorism, or any activity due to conflicts. Such losses are categorised as extraordinary and are outside the scope of agricultural insurance coverage boundaries.

- Nuclear Risks: The scheme also does not include losses due to nuclear risks, such as radiation or contamination. Because these are unpredictable and catastrophic events, they are excluded from PMFBY.

- Riots and Intentional Destruction: PMFBY does not cover losses that result from riots, civil commotion, vandalism, or other human intervention in the form of sabotage or malicious destruction. Damages from deliberate human interventions unrelated to natural disasters or farming risks are excluded from the policy.

- Theft and Animal Grazing: The losses by theft, either by humans or animals or due to grazing from domestic or wild animals, are excluded under PMFBY. These are considered avoidable risks and are not covered within the purview of the policy.

- Post-harvest Losses Under Certain Conditions: Post-harvest losses are not covered under the PMFBY if the crops harvested have been tied and put in a pile before threshing. Also, losses due to avoidable risks like storage or handling issues are not covered.

- Exclusion of Non-Notified Areas: The scheme is implemented only in the notified areas by the government. Crops cultivated in non-notified areas are not within the scope of the scheme, as the farmers in that particular region are not eligible for compensation in case of crop loss.

- Losses Outside the Crop Cycle: PMFBY covers losses that occur during the crop cycle. Any loss that happens outside this cycle, for example, after the crop-growing season, is usually not covered under the scheme.

- Negligence and Non-Compliance: Losses resulting from the farmer's negligence, failure to follow recommended agricultural practices, or insufficient crop protection (such as not irrigating or applying pest control) may not be covered by the insurance policy.

- Losses Beyond Limit Defined: Those losses that surpass the limits specified under the scheme will not be compensated. To be eligible for a claim, the loss must meet the specific criteria set by PMFBY.

- Failure to Pay Premiums: A farmer who does not pay premiums on time stands the risk of losing coverage. The policy can be cancelled in case the premium remains unpaid. Therefore, they would not receive any compensation for the losses during crop failures.

Who Is Eligible for Pradhan Mantri Fasal Bima Yojana?

Let’s look at the eligibility criteria-

- Eligibility of all farmers: The PMFBY covers all farmers, including tenant farmers and sharecroppers, cultivating officially notified crops in designated areas. It is broad in its scope, and therefore, it reaches all forms of agricultural practices.

- Requirement of Insurable Interest: To be insured, the crops under a farmer should have an insurable interest. This requires the farmer to be the landowner, cultivator, or sharecropper, directly benefiting from the crops grown.

- Proof of Land Ownership or Tenure: Farmers must present a valid land ownership certificate or a legally recognised land tenure agreement. This ensures their legal right to farm the land and thus makes them eligible for coverage under the scheme.

- Cultivator or Sharecropper Eligibility: The scheme is available to all farmers, including tenant farmers and sharecroppers, cultivating designated crops in specified regions. This guarantees extensive coverage for a wide range of agricultural activities.

- Timely Application for Insurance: For example, farmers must make an application for insurance within two weeks after the starting date of the sowing season. In the event that a farmer makes his application late, he may lose his coverage for the crops sown for that season.

- No Double Claims for the Same Loss: The same crop loss cannot be compensated by more than one source. This is bound to enhance the fairness factors since farmers should not have previously received compensation from other sources for the same loss.

- Eligibility for Life Insurance: For life insurance coverage under the scheme, savings bank account holders of participating banks between 18 and 50 years of age are eligible. They have to give consent during the enrolment period to be covered.

- Personal Accident Insurance Eligibility: Personal Accident Insurance is available to savings bank account holders who are between 18 and 70 years old. They should either agree to join or allow auto-debit, subject to guidelines. Even joint holders are eligible, provided every holder pays their premium themselves.

Registration Process For Pradhan Mantri Fasal Bima Yojana 2025

To register for this scheme, you need the following documents:

|

Document

|

Details

|

|

Passport-sized Photograph

|

Recent photographs are required with the application.

|

|

Address Proof

|

Aadhaar Card, PAN Card, Voter ID, Electricity Bill, Bank Passbook with Photo.

|

|

Identity Proof

|

An Aadhaar Card, PAN Card, Voter ID, Bank Passbook with Photo, Kisan Photo Book, and NREGA Job Card can be provided as proof of identification.

|

|

Crop Declaration

|

A declaration regarding the crops that have been sown or are planned to be sown.

|

|

Evidence of Land Records

|

In accordance with the State's Records of Rights (RoR), Land Possession Certificate (LPC), and any other relevant agreements or contracts as notified by the state.

|

Kindly consult the official website for the complete list of required documents.

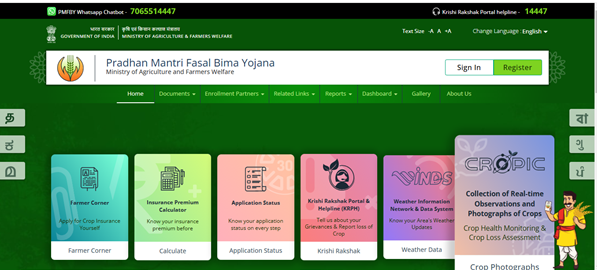

Channels of Enrolment

|

Step

|

Online Application Process

|

Offline Application Process

|

Online—via CSCs

|

|

Step 1

|

Go to the official PMFBY website.

|

Head to the nearest participating bank or insurance office to collect the application form.

|

Visit the closest Common Service Centre (CSC) for assistance.

|

|

Step 2

|

Proceed to "Farmer Corner" at the top right on the homepage; click on the "Guest Farmer" option that will lead to the registration page.

|

Complete the application form, filling in all the required fields.

|

Notify the Village Level Entrepreneur (VLE) of your intention to apply for PMFBY and share the necessary details.

|

|

Step 3

|

All information about the farmer, such as residential addresses, Farmer IDs, accounts, etc., have to be entered in order to complete the registration form.

|

Attach a passport-sized photo; fill in the pertinent fields, and submit all the requirements.

|

Share the required information along with soft copies of the documents with the Village Level Entrepreneur (VLE).

|

|

Step 4

|

If already registered, proceed to Step 4. If not, click "Create User" to complete the sign-up process.

|

Submit the completed form along with the documents.

|

The Village Level Entrepreneur (VLE) will either help you fill out the application or guide you through the process.

|

|

Step 5

|

After registering, go to "Farmer Corner (Apply for Crop Insurance Yourself)" and log in using your mobile number.

|

Make the applicable premium payment at the office.

|

You can pay the premium amount directly to the Village Level Entrepreneur (VLE).

|

|

Step 6

|

Enter the OTP received on your mobile, and click on "Farmer Application Form."

|

An application reference number is provided for tracking the status of your application.

|

An acknowledgement receipt will be provided as evidence of submission receipt.

|

|

Step 7

|

Complete the required fields in the application form and upload the necessary documents.

|

Monitor the status of your application at pmfby.gov.in.

|

You can monitor the progress of your application on the PMFBY website.

|

|

Step 8

|

Review all the details and click on "Submit." Select either "Pay Later" or "Make Payment" to finalise the application.

|

|

Retain copies of all documents as well as the acknowledgement receipt for future reference.

|

|

Step 9

|

Once the payment is successfully processed, you will receive a payment receipt.

|

|

You can monitor the progress of your application on the PMFBY website.

|

|

Step 10

|

You can monitor the status of your application by selecting the "Application Status" option on the PMFBY homepage.

|

|

|

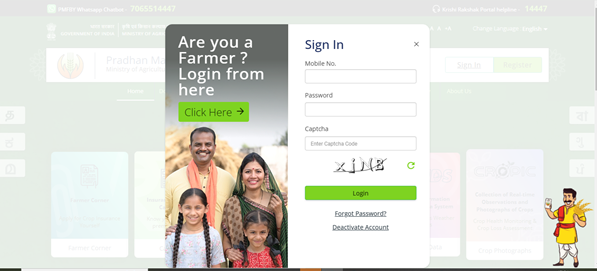

Next Up, Let’s Discuss The PMFBY Login Process

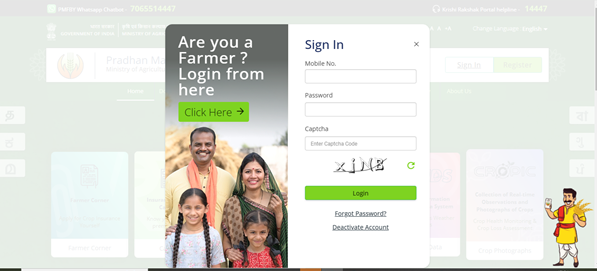

To access the PMFBY portal and track your application status, follow the following steps:

- Head over to the PMFBY portal.

- Click on "Sign In" at the top right corner.

- Enter the registered mobile number.

- Input the password created during registration.

- Complete the CAPTCHA verification.

- Click "Login" to access your account.

Premium Rates Under Pradhan Mantri Fasal Bima Yojana (PMFBY)

Under PMFBY, the premium rate is determined on the basis of the actuarial premium rate (APR), determined by the Implementing Agency (IA). The rates are determined based on the observed loss cost (LC), which is the percentage of claims out of the sum insured (SI) for the previous 10 crop seasons (Kharif/Rabi). Other factors, including the expense of management, capital cost, the margin that insurers obtain, and non-parametric risks, contribute to setting these premium rates. Provided below are the maximum insurance charges farmers have to pay for growing different crops in various seasons under PMFBY:

|

Season

|

Crops

|

Maximum Insurance Charges Payable by Farmer

|

|

Kharif

|

Food & Oilseeds, including all cereals, millets, and pulses

|

2.0% of the Sum Insured (SI) or the actuarial rate*, whichever is lower.

|

|

Rabi

|

Food & Oilseeds, which includes all cereals, millets, and pulses

|

1.5% of the Sum Insured (SI) or the actuarial rate, whichever is lower.

|

|

Kharif and Rabi

|

Annual Commercial / Annual Horticultural Crops

|

5% of the Sum Insured (SI) or the actuarial rate, whichever is lower.

|

*An actuarial rate represents the projected cost of future losses based on risk assessments.

A few important points to be kept in mind:

- Premium Subsidy: The difference between the premium rate and the amount payable by the farmer (insurance charge) is equally subsidised by both the Central and State Governments. This is called the "Rate of Normal Premium Subsidy."

- Actuarial Premium Calculation: Actuarial premium is based on data relating to the latest yield estimates of Kharif crops and Rabi crops. All such data are placed before the Department of Agriculture, Cooperation & Farmers Welfare (DAC&FW) and the respective State Governments before initiating premium bidding.

- Insurance Agency Bidding: State governments invite bids from empanelled insurance companies to submit their actuarial premium rates for the notified crops in specific unit areas. These rates are based on factors like indemnity levels, threshold yields, and sum insured. The bidding process may use a cluster approach, grouping districts with different risk levels for better coverage.

- Bid Compliance: The insurance companies bidding have to provide premium rates for all crops notified by the State Government. If they do not comply with the same, their bid gets rejected.

- Farmer and Hectare Coverage: The coverage, both in terms of the number of farmers and land area, should be at least equal to that of the previous season.

PMFBY Crop Insurance: Understanding the Claim Settlement Process

The claim settlement process in Pradhan Mantri Fasal Bima Yojana (PMFBY) has been formulated so that compensation in respect of crop damage would reach the farmer very timely. It involves reporting losses, evaluating claims, and disbursing payouts efficiently. In fact, it is clear and transparent with steps as follows:

- Notification of Loss: The farmer needs to report the loss to the appropriate authority, insurance company, or state government within 72 hours of occurrence.

- Evaluation of Claim: After the claim report is filed, a joint assessment committee shall be formed, which will comprise members from the state government and insurance company to conduct an evaluation of the reported claim.

- Disbursement of Payout: After assessment, the claim shall be settled with the farmer within 15 days to provide rapid relief.

Latest Changes and Updates

Stay informed about the most recent updates and modifications to the PMFBY scheme to ensure you're aware of any adjustments that may affect your coverage.

- Financial Support: The Union Cabinet has agreed to the continuation of Pradhan Mantri Fasal Bima Yojana (PMFBY) and the Restructured Weather-Based Crop Insurance Scheme (RWBCIS) until 2025-26. The total outlay under both schemes would be Rs. 69,515.71 crore. Thus, crop risk cover for loss because of natural disasters, not prevented, would be continued to the farmers in every nook and corner of India.

- Innovation and Technology Infusion: A fund for innovation and technology (FIAT) amounting to Rs. 824.77 crore has been approved to infuse technology into the scheme, thus making it more transparent and efficient. Initiatives like YES-TECH—Remote Sensing for yield estimation and WINDS—Weather Information Network and Data Systems shall enhance the precision of claim computation and hasten the settlement process.

- Technological Innovation:

YES-TECH: Crop yield estimation is done with remote sensing by the company with 30 percent tech-based weightage. So, it's to be used gradually to substitute the crop-cutting experiments happening across nine major states.

WINDS: Aims to bring in block-level and panchayat-level weather stations, increasing network density fivefold compared to other states.

- Emphasis on North Eastern States: Special attention is given to completing all the North Eastern states, and the central government pays 90% of the premium subsidy. Since participation is voluntary and the cropped area is limited, unused funds can be reallocated to other state development initiatives for better resource utilisation.

- Remarkable Growth and Expansion: PMFBY, since its inception in 2016, has enrolled as many as 56.80 crore farmers and released over Rs. 1.55 lakh crore in claims. The scheme has seen an upsurge in voluntary enrolment, and for the 2023-24 period, there is an increase of 27% in farmer enrolment. Interestingly, 42% of insured farmers are non-loanees.

- Ongoing Improvement and Expansion: The program is constantly reviewed to overcome operational challenges and increase efficiency. Some of the recent updates include the simplification of the three-year insurance company selection process, the adoption of alternative risk models, integration with advanced technologies such as NCIP and YES-TECH, and an increase in IEC efforts to increase coverage and ensure that claims are settled promptly.

PMFBY Success Stories: Real Impact on Farmers' Lives

Explore how the Pradhan Mantri Fasal Bima Yojana has made a significant difference in the lives of farmers, helping them recover from crop losses and continue their agricultural activities.

- Surge in Farmer Participation: During 2023-24, PMFBY witnessed the highest-ever farmer enrolment to date. This time, there was a spurt in enrolment by women farmers during the 2022-23 seasons also, reflecting increased acceptance among the diverse farming fraternity.

- Timely Claim Settlements: The government has made it a priority to ensure swift claim payouts. By August 2024, 98% of reported claims were processed and paid, providing timely financial relief to farmers affected by crop losses.

- Technological Innovations: The establishment of the Fund for Innovation and Technology (FIAT) has fostered initiatives like YES-TECH (using remote sensing for yield estimation) and WINDS (improving localised weather data collection), enhancing transparency and accelerating the claims process.

- Widespread Awareness Efforts: The awareness campaigns have been successful in reaching farmers across the country, and the highest levels of understanding are found among those aged 40-59 and from the OBC category, thereby ensuring a greater number of farmers are informed about the benefits of the scheme.

- Sustained Government Commitment: The Union Cabinet’s decision to extend PMFBY until 2025-26 ensures continued financial backing and support for farmers facing the unpredictability of natural disasters, reflecting the government's ongoing dedication to the scheme’s success.

Summing It Up!

PMFBY is a promise that whatever effort an Indian farmer takes will not be wasted while being a package of subsidised premiums, comprehensive cover, and high-tech implementation for farmers, as the technology introduced under PMFBY provides claim efficiency. This ensures farmers' secure livelihood and makes the agricultural economy stronger through scheme features and enrolment procedures.

So, next time a farmer ponders, What if disaster strikes? They now need not be puzzled because PMFBY stands up for the latter.

Disclaimer

The content on this page is generic and shared only for informative and explanatory purposes. It is sourced from multiple online resources and may be subject to change. Kindly seek advice from an expert before making any decisions related to the discussed subject matter.

FAQs