You are at the supermarket with a list that mom tucked in your pocket. You carefully check each item and after 20 minutes, the cart is full of groceries. The billing is done, bags are packed, and just as you reach for your wallet, your heart skips. “Did I forget it at home?” That one moment of doubt feels heavier than all the bags in your hands.

Now, the same can happen with your drives. Smooth road, windows down and you are navigating with a map. That is when you see a billboard that says there is a toll gate in 1km. But you pause for a second. “Do I have enough balance on my FASTag?” That same uneasy feeling creeps in, just like at the shopping counter.

No one wants their ride to be interrupted over something so small. The good news is, checking and recharging your IDFC FASTag doesn’t need to be a worry at all. In fact, it’s quick and effortless if you know the right ways. In the guide below, we’ll go through seven simple methods to stay ready every time you hit the road.

Why IDFC First Bank FASTag Balance Check is Important?

An IDFC FASTag is directly linked to your prepaid account or wallet. Each time you cross a toll booth, the tag deducts the toll amount automatically. But if your balance drops below the required amount, the transaction fails. This can result in:

- Waiting in the cash lane, which usually takes longer.

- Paying penalties or higher charges at some toll plazas.

- Disruptions in travel, especially during long-distance trips where multiple tolls come back-to-back.

Checking your Fastag balance frequently avoids sudden surprises. It also helps frequent travelers track monthly toll spending. Thus, it is wise to keep some buffer balance to avoid failed toll transactions. If you're on the road every day, knowing your balance is as important as knowing your fuel level.

Methods to Check IDFC First Bank FASTag Balance

IDFC provides multiple online and offline options for balance checks. Each method has its own advantages depending on how you manage your account.

- IDFC FASTag Mobile App - IDFC FASTag Mobile App

- IDFC FASTag Web Portal

- IDFC SMS Alerts & Missed Call Service

- IDFC Customer Care Helpline

- IDFC Email Notifications

- MyFASTag Mobile Application

Let’s now look at each one in detail.

IDFC FASTag Mobile App

The IDFC FASTag mobile app (available on Android and iOS) is the quickest way to check your tag balance. You can first login with your registered mobile number and OTP. Once in, you can:

- View the balance of each FASTag linked to your account.

- Track toll transactions with date, time, and other such details.

- Recharge your balance using debit card, net banking, or UPI.

- Most recharges reflect almost instantly, though in rare cases it can take 10-15 minutes for the balance to update.

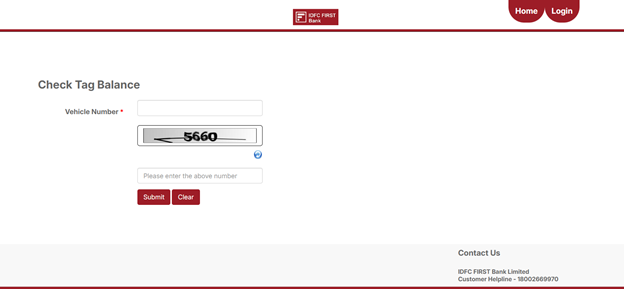

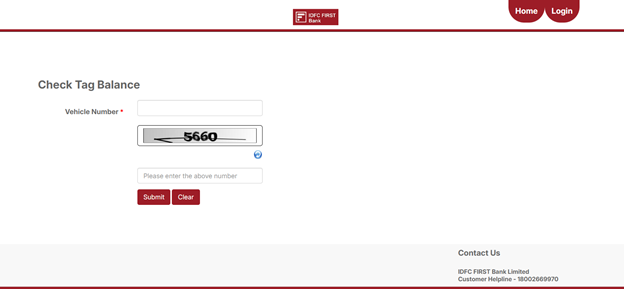

IDFC FASTag Web Portal

The IDFC First Bank FASTag portal can be accessed at etoll.idfcbank.com. Once you log in with your vehicle details, you can:

- Check the balance of your FASTags under your customer ID.

- Download detailed monthly or yearly statements.

- Keep a track of pending or failed recharge attempts.

The portal is especially useful for fleet owners or businesses that manage multiple vehicles.

SMS Alerts & Missed Call Service

-

SMS Alerts: Once you cross a tollgate, the transaction triggers an SMS to your registered mobile number. When you receive the message, it is very detailed. It includes the toll amount deducted, the plaza name, and the remaining balance.

- Missed Call Service: IDFC also helps you with a dedicated missed call number. By giving a missed call to +91-9990243331 from your registered mobile, you’ll instantly receive an SMS with your current FASTag balance. This service works 24/7 and doesn’t require internet access.

Customer Care Helpline

The next option is where you can check your balance by calling the IDFC FASTag toll-free helpline 1800-266-9970. After verifying your registered mobile number and vehicle details, the executive will provide your tag balance. The helpline also assists with recharge failures, tag replacement, and blacklisted tag issues.

Email Notifications

Registered users automatically receive email updates for every toll deduction and recharge. These emails include:

- Transaction ID

- Toll plaza name

- Amount deducted

- Updated balance

Since emails can be stored indefinitely, they work well as a record for reimbursement claims or tax purposes.

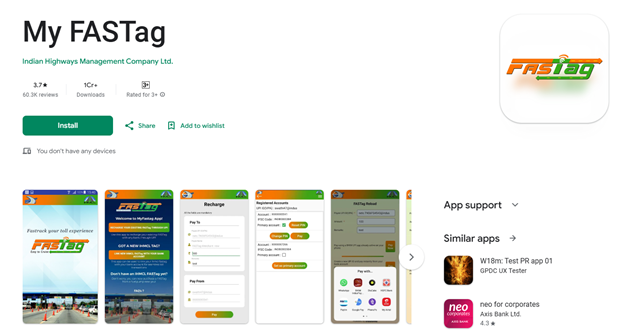

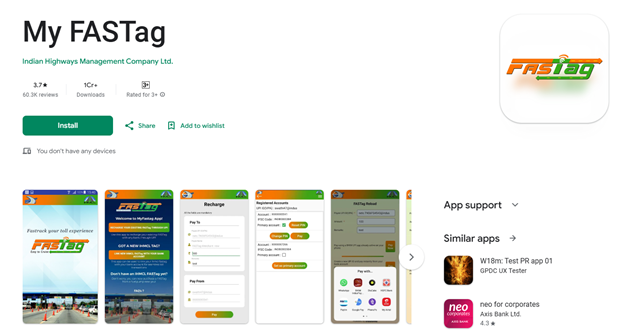

MyFASTag Mobile Application

Apart from IDFC’s own app, you can also use the MyFASTag app by NPCI. Once you link your IDFC-issued FASTag in the app, you can:

- View live balance.

- Recharge using UPI, net banking, or linked wallets.

- Access NHAI “FASTag Recharge” options directly.

This app is especially helpful if you own multiple tags from different banks, since it shows them all in one place.

FASTag Update: One Vehicle, One Active Tag Rule

Benefits of Using IDFC First Bank FASTag

The biggest benefit of FASTag is that you don’t have to stop at toll booths. The tag uses RFID technology to deduct tolls directly from your prepaid balance, which cuts down waiting time. For IDFC FASTag users, there are a few extra advantages:

- Nationwide acceptance: The tag works across more than 1,000 toll plazas on national and state highways.

- Instant recharge: You can top up using UPI, debit card, credit card, or net banking through the IDFC app or portal.

- Detailed statements: Every transaction is recorded, and you can download monthly or yearly reports from the portal.

- Auto-recharge setup: IDFC lets you enable auto-debit from your linked account so your tag never runs low.

- Cashback schemes: From time to time, NHAI and banks offer cashback on toll payments made via FASTag.

For businesses that manage fleet vehicles, IDFC FASTag can be a great choice.

Fees and Charges to Check IDFC First Bank FASTag Balance

Checking your FASTag balance is free. IDFC does not charge for SMS alerts, email updates, mobile app usage, or web portal access. What you do pay for is maintaining and recharging the FASTag:

- One-time tag issuance fee: Around Rs. 100 (may vary).

- Refundable security deposit: Ranges from Rs. 200 to Rs. 500 depending on vehicle type.

- Minimum first recharge: Typically Rs. 100 to Rs. 200 at the time of activation.

Remember that there are no charges for balance inquiry. But you should ensure your registered mobile number remains active to continue receiving SMS and missed call updates.

Common Issues in IDFC First Bank FASTag Balance Check

Some users face hurdles when checking their FASTag balance. The most common ones include:

- Delayed balance update: Sometimes the app or portal shows the old balance even after a recharge.

- SMS not received: Network issues or an inactive mobile number can prevent alerts from arriving.

- Missed call failure: Calling from an unregistered mobile number won’t work.

- Portal login errors: Forgotten passwords or server downtime may block access.

How to Resolve FASTag Balance Issues?

If you run into problems, here are some ways to fix them:

- Delayed update: Wait for 15-30 minutes, then refresh the app or portal. Most recharges reflect within this time.

- SMS not received: Check if your mobile number is registered and has network coverage.

- Missed call failure: Always use the registered mobile number. If it still fails, try the app or web portal.

- Portal login errors: Use the "Forgot Password" option on the login page. IDFC sends reset instructions to your email or mobile.

For unresolved issues, call the IDFC FASTag helpline at 1800-266-9970 or raise a request through the portal.

Tips for Smooth IDFC First Bank FASTag Usage

A few simple habits can help avoid problems and keep your FASTag running smoothly:

- Maintain a buffer: Keep at least Rs. 200 - Rs. 500 in your balance, depending on how often you travel.

- Recharge in advance: If you’re planning a long trip, top up a day before.

- Enable auto-recharge: Link your account for automatic top-ups to prevent sudden balance drops.

- Keep your number active: Ensure your registered mobile number is working so you don’t miss SMS alerts.

- Check for offers: Occasionally, IDFC and NHAI run cashback or discount campaigns.

- Monitor transactions: Review your portal or app statements monthly to catch any errors quickly.

Following these steps makes travel more predictable. With a charged tag and reliable alerts, toll booths become a quick pass-through rather than a delay.

IDFC First Bank FASTag Customer Support & Contact Details

Even with smooth operations, you might sometimes need help with your FASTag. IDFC offers multiple channels for support:

|

Helpline Number

|

1800-266-9970 (toll-free, available 24/7)

|

|

Email Support

|

fastag.support@idfcfirstbank.com for queries, complaints, and recharge issues

|

|

Web Portal Support

|

IDFC FASTag Login allows you to raise service requests, track complaints, and view statements

|

|

Mobile App Help

|

Through the IDFC FASTag app, you can access FAQs, chat support, and raise ticketed requests

|

Using these options, issues like delayed recharge, balance discrepancy, or tag deactivation can usually be resolved within 24-48 hours.

Wrapping Up

IDFC First Bank FASTag makes road travel faster and hassle-free. With real-time balance tracking, multiple recharge options, and consistent alerts, it keeps toll payments simple. By using the mobile app, web portal, or MyFASTag app, you can always stay in control of your account. A little attention like keeping balances topped up, checking statements, and following simple usage tips ensures smooth journeys every time.